We assist you locate a finance that fits your budget plan in a timely fashion as well as make your romantic wedding come to life. Send the necessary records either online or to the agent of your lender when he/she gets in touch with you. Check out the website of your picked lender, fill the required details in the online form and also send. A financing is much better than both the alternatives, as it ensures your financial savings and investments are risk-free. You can select from several sorts of fundings, although you ought to select a Flexi financing if you want control over your finance quantity. If you're seeking to use instant funds, a Flexi-Personal Lending would certainly be the right option.

For people who seek a strategic way to regulate their finances as well as month-to-month expenditure, a flexi car loan might supply you with alternative means to regulate your budget plan. A flexi loan is a different solution and a means to avoid building up high rates of interest. Flexi fundings such as the ones provided by Ellinas Money, manage various benefits that personal fundings typically lack. In a Flexi financing, interest rate is charged only on the amount withdrawn and also not on the pre-approved loan quantity. You can pay back the finance in EMIs calculated on the withdrawn amount only. The funding can be closed before the tenure finishes by pre-paying the outstanding debt, in situation you have added funds.

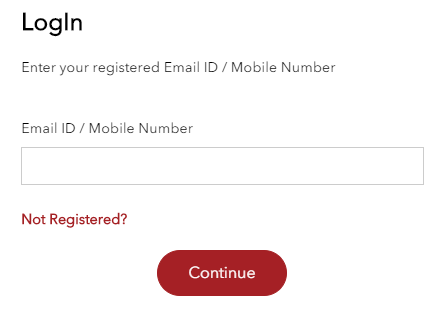

- Just enter your individual information into the form to enjoy a personalised loan offering from Bajaj Finserv as well as an expedited application process.

- Conversely, many individuals redeem their investments to fulfill financial problems.

- On the other hand, the complete car loan quantity is paid out to your checking account in the Term Funding.

With a Flexi Personal Financing, you can select to pay interest-only EMIs through the initial part of the tone. With interest-only EMIs, you can have the trip of life time and also repay it pleasantly when you're back. This attribute additionally allows you minimize your month-to-month instalments by as much as 45% and you can use the EMI calculator for a much more thorough failure of your financial obligation. This can be a wonderful boon to finance your itinerary as choosing optimal settlement choices is just as essential as safeguarding the required financing. With the trend of holidaying multiple times in a year taking a solid foothold in India, many loan providers and travel business have reported intriguing searchings for on the subject. A big rise, varying from 50% to 60%, has actually been reported in variety of personal loans considered travel.

All educators can avail instant authorization and fast disbursal for Bajaj Finserv Personal Car Loan for Teachers as much as Rs 25 lakh. Inspect Bajaj Finserv Personal Funding Eligibility to request car loan for instructors. 4) No need to release cheques by capitalists while registering for IPO. Just compose the bank account number and sign in the application to authorise your financial institution to pay in instance of quantity. No worries for refund as the cash stays in investor's account.

We do not charge anything added for each and every withdrawal as well as part-prepayment you make. So, you can foreclose your loan in advance of schedule to minimize your rate of interest outgo. Likewise, we do not request for additional documentation for withdrawals and part-prepayments. You can just negotiate online, and obtain as well as transfer funds, via our consumer portal-- Experia. Utilize our customer portal-- Experia, to move funds from your car loan limitation to your funding account as well as make early repayments. You can access your account 24/7 by means of electronic banking or telephone financial to make payments or withdrawals.

2 Wheeler Financing

We have easy qualification requirements and need a fundamental set of records to accept of your finance. Flexi finances by Bajaj Finserv are the brand-new way of borrowing funds in India. You obtain a pre-approved financing restriction based upon your credit report account Go to the website and can use it to meet your funding needs on the go. You can withdraw funds from this limit whenever you need financing as well as can prepay them whenever you have surplus cash in hand. You pay interest only on what you withdraw from your funding restriction and also not on the entire sanction.

Your Cibil Score And Also Your Personal Funding

All you need to do is pledge your equity shares, mutual funds, bonds or protections as well as obtain accessibility to immediate liquidity. The amount taken out throughout the finance period must be within the restriction of the amount pre-approved by the lending institution. For example, if you have a designated sanction of Rs 5 lakh, you might request a flexi finance of Rs 3 lakh or any kind of amount below the cap of Rs 5 lakh.

Obtain Upto 33% Off + Additional 10% Off *

Get flexible periods approximately 36 months as well as repay your Microfinance financing EMI according to your comfort. You can withdraw the needed quantity of cash from your Flexi lending account any time you want. There is no limitation on the variety of times you can withdraw funds from the lending account. You just need to see to it that you withdraw a quantity within the credit limit accepted by your lender.

CreditMantri was developed to assist you organize your credit health and assist you make much better loaning choices. If you are looking for credit history, we will ensure you locate it, as well as make certain that it is the most effective feasible match for you. We allow you to acquire your credit score quickly, online, actual time.

Obtain a car loan from anywhere in India simply by addressing some concerns on the internet site or application. These information will certainly be utilized to analyze the qualification for business funding. In regards to the overall expense of the finance, the EMIs for a term finance is fairly greater, as the interest is calculated on the general amount. Instead, make use of Flexi fundings where you only need to pay passion on the amount which is withdrawn. The majority of the Flexi Finances being provided require a minimum collection of papers in order to offer a credit limit to both employed and also self-employed experts.